Handy Reasons On Selecting Credit Card Apps

Wiki Article

What Can I Do To Find Out If My Card Was Reported As Stolen In The United States?

If you want to determine whether your credit card was reported as stolen in the USA, follow these steps: Contact Your Credit Card Issuer-

Call the number listed on the backside of your credit card.

Inform the representative that are looking to confirm the status of your credit card, and whether it has been reported stolen or lost.

Make sure you have your personal details and credit card details for verification for verification purposes.

Verify Your Online Account

Log in to your online bank account or credit card connected to the card in question.

Be on the lookout for alerts or messages regarding your card's status.

Check recent transactions in order to identify any suspicious or illegal transaction.

Monitor Your Credit Report

Obtain a free copy of your credit report from each of the three major credit bureaus (Equifax, Experian, TransUnion) through AnnualCreditReport.com.

It is recommended to check your credit reports for any suspicious inquiries or unidentified credit accounts.

Security Freezes, Fraud Alerts and other measures

Consider putting a fraud alert, or security freeze, on your credit score in the event that you suspect fraud or theft of personal data is taking place.

A fraud alert will inform creditors that they need to be extra cautious to confirm your identity before extending credit. But, a credit freeze will limit access to your credit report.

Make sure to report any suspicious activities that are suspicious.

Be sure to check your credit card statement regularly and inform the card issuer of any suspicious or unauthorised transactions.

If you suspect identity theft or fraud to the Federal Trade Commission (FTC) and make a report to the local law enforcement agency.

You can protect yourself from fraud with your credit card by contacting the card issuer and examining your account online. It is also important to monitor your credit report and be alert to any sign of unauthorised activities.

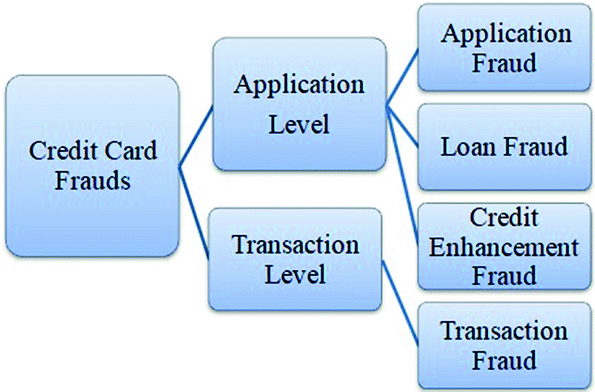

What Does It Mean For My Credit Card To Be Placed On The Blacklist?

The card is limited to certain transactions and use until the issue is fixed by the cardholder or card issuer. The reasons for a card being added to a blacklist can vary and include

Suspected Fraud - Card blocking to protect yourself can be initiated by unusual or suspicious transactions which trigger fraud detection software.

Security Concerns. If evidence suggests a possible security breach, such as unauthorized access, or data breaches that affects the card's details or unusual spending patterns then the card will be identified as a security risk.

Identification Verification Problems: When the cardholder isn't able to verify their identity, it can temporarily stop the card. This happens when there are additional verification requirements.

Lost or Stolen CardIn the event that the card is reported stolen or lost by the card holder, the issuer could place a block on the card to prevent unauthorized use until a new card can be issued.

Suspicious Activities Indicators - Any act or occurrence that is entailed with a card and could raise suspicion can trigger an immediate block. For example, several declined transactions, geographic anomalies, or irregular spending patterns.

A card that is as blacklisted may restrict the ability of the cardholder to get credit or purchase items using the card. This may be until the card issuer confirms the authenticity of the account, or resolves any concerns regarding security or fraud. It's essential for the cardholder to get in touch with the issuer immediately to resolve the issue, confirm the validity of transactions, and deal with any security issues that could be associated with the card.

What Is The Minimum Qualification For Someone Who Can Run An Account For A Credit Card On A List App?

Validating credit card numbers against a blacklist or checking for suspicious activity with credit cards is usually done by authorized personnel within financial institutions, law enforcement agencies, or cybersecurity firms. These professionals include- Fraud Analysts- Trained individuals within financial institutions who specialize in identifying and investigating fraudulent activities related to credit card transactions. They employ special software and tools to identify patterns or irregularities as well as potentially compromised card numbers.

Cybersecurity Experts: Specialists with specialization in cybersecurity. These professionals analyze and detect cyber-attacks, such as stolen credit card numbers. They are involved in protecting against data breaches, analysing data for signs of compromise and then implementing security measures.

Specialized units within law enforcement agencies or those who are able to investigate financial crimes including fraud with credit cards. They have access resources and databases that allow them to monitor and investigate fraudulent transactions.

Compliance Officersare professionals in charge of ensuring compliance with the laws and regulations pertaining to financial transactions. They are also responsible for overseeing the processes of identifying and reporting suspicious activities associated with credit cards.

Databases that contain blacklists of credit cards and the authority to validate the credit card number against these lists is strictly controlled. This requires legal authorization.

These qualified individuals or teams use special equipment, protocols, legal procedures and specialized software to verify that credit card information is not on blacklists. All this is done in a strict compliance with the privacy and security rules. In order to ensure that your credit card details are not hacked, always trust reputable experts and institutions. Unauthorized attempts of accessing or using blacklists for credit card information could result in legal consequences. See the best savastan0 cc for more recommendations.